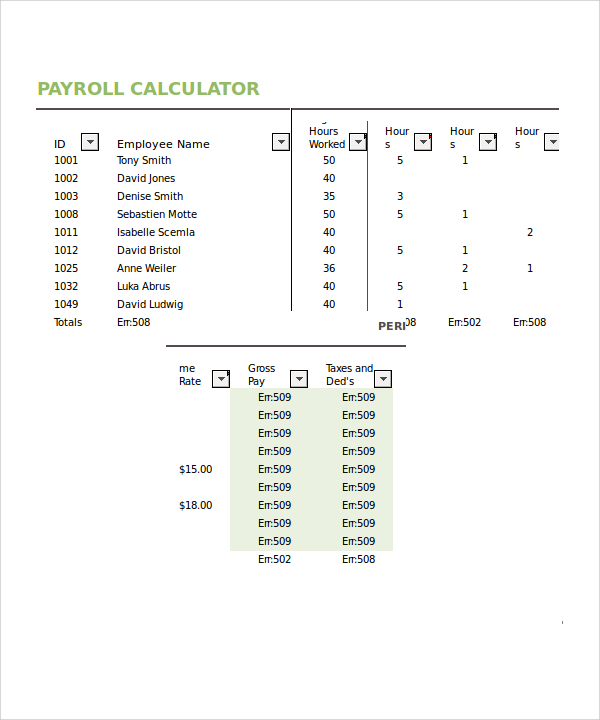

Free Pay Stub Template With Calculator

Looking to pay your employees, quickly and accurately? Intuit’s free paycheck calculator makes it a cinch to calculate paychecks for both your hourly and salary employees. Enter your employee’s pay information and we'll do the rest. We make sure the calculations are accurate by using the most up-to-date tax table. Once you do, the payroll calculator with the pay stub template will pop up for you to click on and use. Step three would be for you to input employee information into the pay stub. The pay stub template consists of three pages. The first contains the information of the employee.

Use our Free Paycheck Calculator spreadsheet to estimate the effect of deductions, withholdings, federal tax, and allowances on your net take-home pay. Unlike most online paycheck calculators, using our spreadsheet will allow you to save your results, see how the calculations are done, and even customize it.

Update 1/3/2019: I have updated the tax tables for 2019 based on IRS Notice 1036.

Paycheck Calculator for Excel

for Excel and OpenOffice'No installation, no macros - just a simple spreadsheet' - by Jon Wittwer

Pay Stub Template Fillable

Download

FreeTemplate Details

License: Private Use

Free Editable Pay Stub Template With Calculator

(not for distribution or resale)Description

Estimate your Net Take Home Pay using this Paycheck Calculator for Excel. Answer questions such as:

- How do the number of allowances affect the federal tax withholdings?

- How much will my take-home pay change if I contribute more to my 401(k)?

Update 4/20/2018: Updated the .xlsx version to subtract Health Insurance Premiums when calculating the net take-home pay.

How Do W-4 Allowances Affect Take-Home Pay?

Using the Paycheck Calculator

- Enter your Gross Pay for monthly, semi-monthly, biweekly, or weekly pay periods.

- Federal taxes are calculated using tables from IRS Publication 15 for tax year 2019.

- FICA Social Security Tax and Medicare are calculated based on the percentage of your Gross Pay.

- State and Local taxes are estimated by multiplying the federal taxable gross by a percentage that you input.

- Read the cell comments if you need more information about an input or calculation.

Paycheck Calculation References

- Notice 1036 (Rev Dec 2018) - Early Release Copies of the 2019 Percentage Method Tables for Income Tax Withholding.

- IRS Publication 15 (Employer's Tax Guide) (.pdf) at www.irs.gov - The official source for information about payroll taxes in the US.

- State Income Tax Rates at taxfoundation.org - Information about state income taxes. You should also check your state's department of revenue website.

- Payroll Tax Deductions Calculator at bankrate.com - This is an online paycheck calculator that I used to help verify the net take home pay calculations in the spreadsheet.

- Hourly Wage Pay Calculator at dinktown.net - This online paycheck calculator lets you enter hours worked and your hourly wage.